The Breakout List for Climate

Joining a company that’s on a breakout trajectory has many benefits: a rapid rate of learning, talented friends, the potential to make retirement money, and it can be really fun. I’ve seen this firsthand as part of the early team at three different unicorns (Clubhouse, Faire, and Opendoor).

Over the past year, I’ve begun to embed myself in the climate world. I want to help save our planet, and we need to act quickly to do so.

I have to admit I was skeptical - in the past when I've looked, climate as an industry has felt like philanthropy. But as I've dug in this past year, I've realized there are now trillions of dollars in demand and investment for climate solutions. From $1.1T in climate investment in 2022 (more than oil and gas), to $369B in federal climate funding, to real demand for permanent carbon removal, to proposed SEC requirements for climate disclosure, to examples of climate winners from Tesla to Impossible Foods, to the billions in dry powder available in climate VC, and more - I've become convinced that there are many, many real businesses to be built. I expect multiple trillion-dollar climate companies to be created as we refactor the world economy in the coming decades to keep our planet habitable.

I often have friends who are looking for new jobs ask about climate tech, many asking me which climate tech startups to join. This is the list that I send them.

I've looked at hundreds of climate startups in the past year and talked to lots of founders and VCs, and these consistently rise to the top. I've included these companies because they fit the criteria I've used for breakout company selection before - TAM, team, great early investors, and a clear mission. When I joined Opendoor, half of my short list of companies hit hypergrowth and would've been career-defining companies to join; when I joined Faire, that number was 7/10. I'm happy to say that I feel similarly bullish about a number of climate tech startups.

It's also a great time to found a startup, with tons of available capital for all stages despite the broader tech pullback, and many more startups needed. We especially need startups that solve physical problems (bits plus atoms) and founding teams that pair great scientists with startup-minded founders with a bias to action.

If you have suggestions or additions, please feel free to reach out at dan@dashton.org.

Breakout List for Climate

- Charm

- Watershed

- Redwood Materials

- Pachama

- Heirloom

See below for more detail on each, Honorable Mentions, and top investors.

Charm

Putting oil back underground.

Charm moves fast. They've gone from commercial launch to ~90% of the permanent carbon removal market (which is accelerating in demand) in a year. Charm creates bio-oil from agricultural residue, then sequesters it underground. Think melting corn stalks after harvest - which would otherwise release carbon back into the atmosphere - and putting that back securely in oil wells, creating permanent storage in these deep geological formations. A fast-moving team with with startup DNA, Charm has quickly grown to be the market leader in permanent carbon removal.

- Employees: 11-50

- Valuation / total funding: $127M / $26M

- Last announced funding: unnamed round (2022)

- Founders: Kelly Hering, Shaun Meehan, and Peter Reinhardt (Co-Founder/CEO, Segment)

- Highlights: female-founded, world-class founder

Watershed

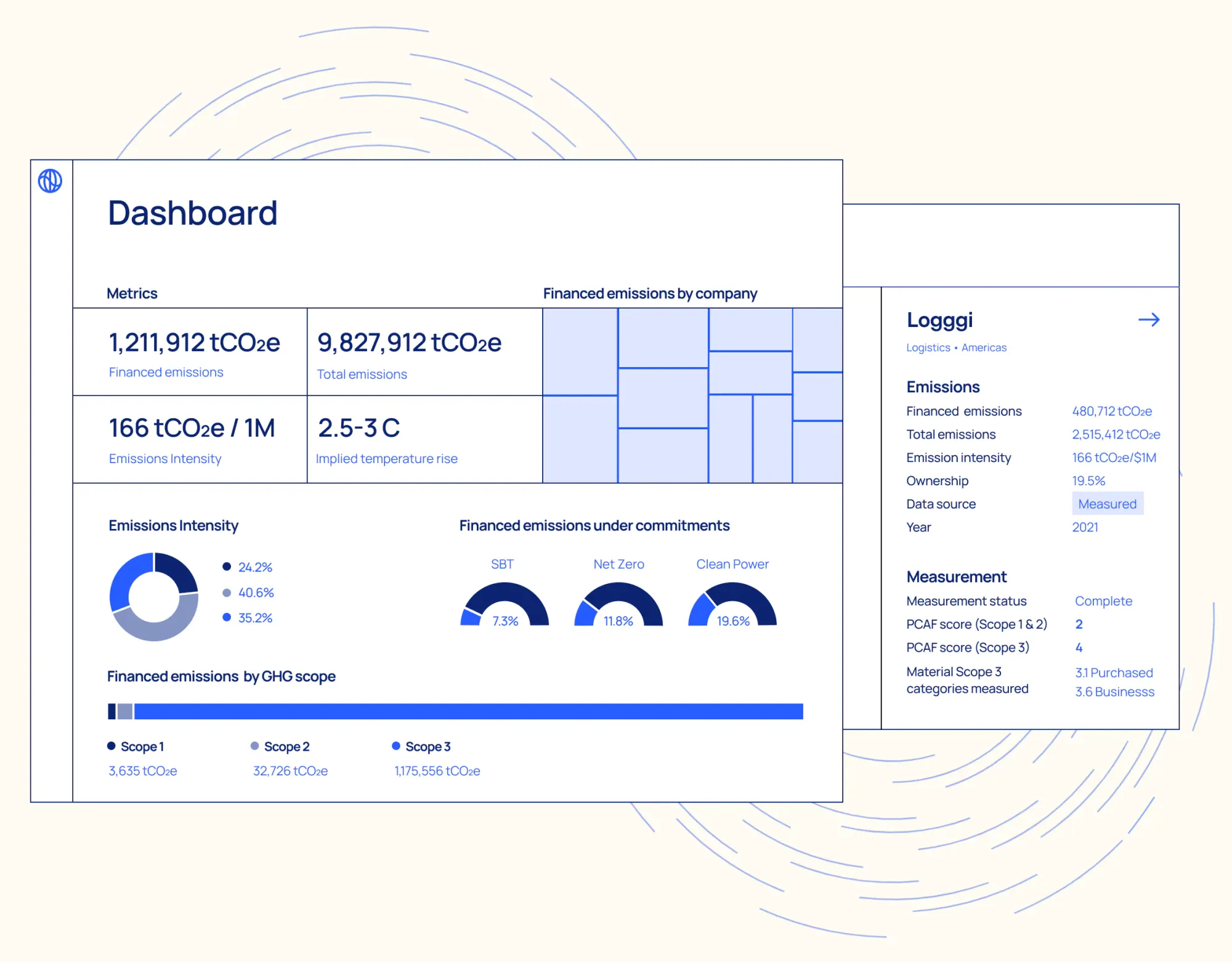

Stripe for carbon accounting.

Someone has to win in climate accounting, and it's likely to be Watershed based on their head start, funding, and team quality. Watershed lets companies measure emissions, reduce them, and report in a rigorous way. Watershed is among the best positioned to build this piece of core climate infrastructure, and even has world-class investors Mike Moritz (Sequoia) and John Doerr (Kleiner) on the Board for the first time they've been paired since Google. In the short run, Watershed needs to grow into its valuation; in the long run though, Watershed could even own the marketplace where all tech-enabled companies go to reduce their emissions - a powerful perch in the ecosystem.

- Employees: 101-250

- Valuation / total funding: $1B / $70M

- Last announced funding: Series B (2022)

- Founders: Taylor Francis, Christian Anderson, and Avi Itskovich

- Highlights: world-class board

Redwood Materials

A gigafactory in reverse.

Battery recycling will be enormous as we electrify our cars and grid, and will eventually compete with mining - the raw materials will be easier to access in an old battery than in rock miles underground. Winning will require highly precise engineering, almost looking like a Tesla gigafactory in reverse (instead of putting components together, taking them apart). Who better to solve it than Tesla Co-Founder and CTO JB Straubel? It’s a highly capital intensive bet and requires an elite founder and great storytelling to raise the billions of dollars required to win, and on a long enough time horizon (decades), this company may be one of the world's largest.

- Employees: 501-1000

- Valuation / total funding: $3.7B / $792M

- Last announced funding: Series C (2021)

- Founders: JB Straubel (Co-Founder/CTO, Tesla)

- Highlights: world-class founder

Pachama

Legitimate forestry credits.

Forestry credits have been plagued by many issues, sometimes including fraud. Issues persist of uncertain additionality, permanence, verification, and more. Pachama solves a lot of these issues by using satellite imagery and ML to measure, verify, and report on forestry emissions. They have an impressive customer base, a solid strategy, and may play a key role in saving and expanding forests, which will be an important piece of the climate puzzle.

- Employees: 51-100

- Valuation / total funding: undisclosed / $79M

- Last announced funding: Series B (2022)

- Founders: Diego Saez-Gil, Tomás Aftalion

- Highlights: URM-founded

Heirloom

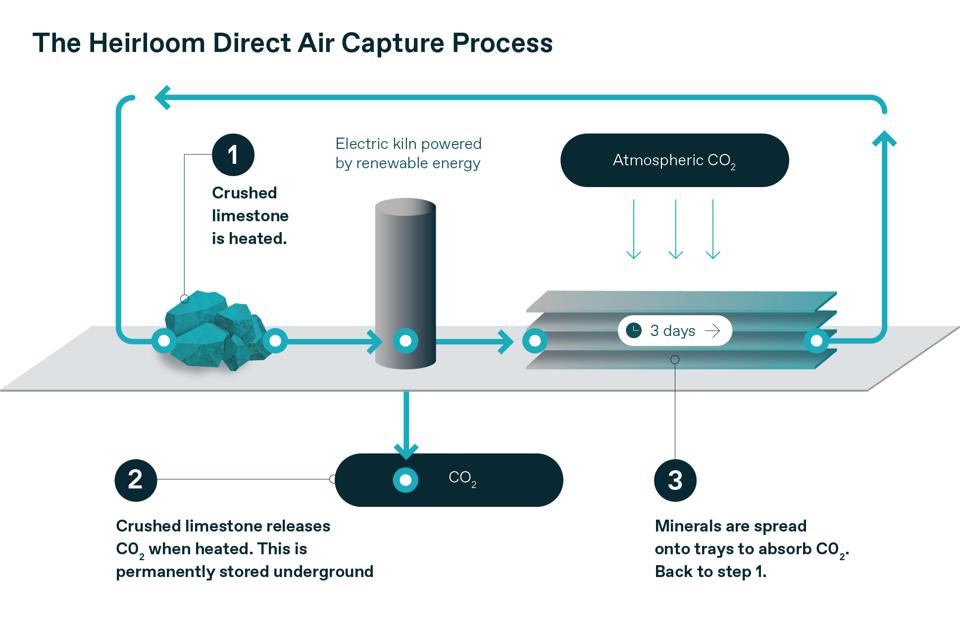

Taking carbon out of the air.

Direct air capture (DAC) of carbon will likely play an important role in getting to net-zero emissions. Heirloom heats limestone to remove CO2 and stores it underground, with the secret sauce of compressing a process that takes years to mere days. Heirloom has an impressive scientific team and advisors, including Dr. Jennifer Wilcox, whose lab spun out the initial technology. They're among the more speculative companies on this list, as they're aiming to deploy their first site this year.

- Employees: 51-100

- Valuation / total funding: undisclosed / $54M

- Last announced funding: Series A (2022)

- Founders: Shashank Samala, Noah McQueen

- Highlights: LGBTQ+-founded

Honorable mentions:

- Helion - fusion power. The first private company to reach 100 M°C plasma temperatures, the YC (S14) company seems to have a head start and the culture of a startup. Chairman Sam Altman (OpenAI, YC) believes so strongly in Helion that he personally led most of the recent $0.5B Series E ($1.7B more in funding is tied to performance milestones). Fusion is "always 30 years away," otherwise this would be on the main list.

- Commonwealth Fusion Systems - fusion power. Spun off from MIT, the technology is based on the ARC (think Tony Stark) tokamak concept from the MIT Plasma Science and Fusion Center. Recently raised a $1.8B Series B. Fusion is "always 30 years away," otherwise this would be on the main list.

- Mill - eliminating food waste. Put your food waste in a special bin that conserves the nutrients and send it back to farms to feed animals. Food waste is a huge source of methane at multiple stages in the cycle, and the founding team is stellar, led by Matt Rogers, Co-Founder of Nest. The product hasn’t shipped yet, but you can get on the waitlist!

- Cana - beverage printing to reduce waste. Emissions and waste occurs in beverages through things like transportation and packaging, which Cana largely eliminates by printing your drink! Cana can brew coffee, pour you juice, create personalized sparkling water, or even make you specialty cocktails. From David Friedberg of the All-In Podcast, who also had one of the best exits in climate tech (The Climate Corporation sold for $1.1B). Futuristic, hasn’t shipped yet.

- Patch - an API for carbon removal. Patch lets you embed climate emissions estimates and carbon credit purchases in any product experience. While there are some valid criticisms about the quality of offsets that exist, which is reflected on their marketplace, Patch also provides detailed contextual data about projects, so hopefully quality can be improved with time.

Top climate VC portfolios:

If you want to explore more companies for yourself, these portfolios tend to be some of the best in climate tech.

- Breakthrough Energy Ventures - Bill Gates started this fund, aimed at revolutionary technologies that can eliminate at least a half a gigaton of emissions & have strong commercial/fundraising viability. Also, check out his book for a good climate primer.

- John Doerr’s investments - the Kleiner Perkins Chairman has been an early and strong investor in climate technologies going back to Cleantech 1.0, and recently endowed the Stanford Doerr School of Sustainability with a $1.1B donation. Another great book to read from the OKR guru.

- Lower Carbon Capital portfolio - Chris Sacca’s fund focused on climate raised $800M quickly, based on his reputation for early bets on Twitter and Uber. A special focus on carbon dioxide removal, the fund invested in Heirloom and Charm from this list.