Climate Tech 101 (Part 3): What Wins

Welcome to Part 3 of Climate Tech 101!

In previous posts, we covered the basics of climate change, three buckets of climate tech, and the Breakout List for Climate.

In this post, we’ll retro the technologies that won and lost in the past (including during the CleanTech bubble of the 2000s), to see what's common among the winners. Hopefully that helps you learn from the past, without having to do the research yourself.

Onward!

Part 3: What Wins

Here's a summary of what we'll cover in this post:

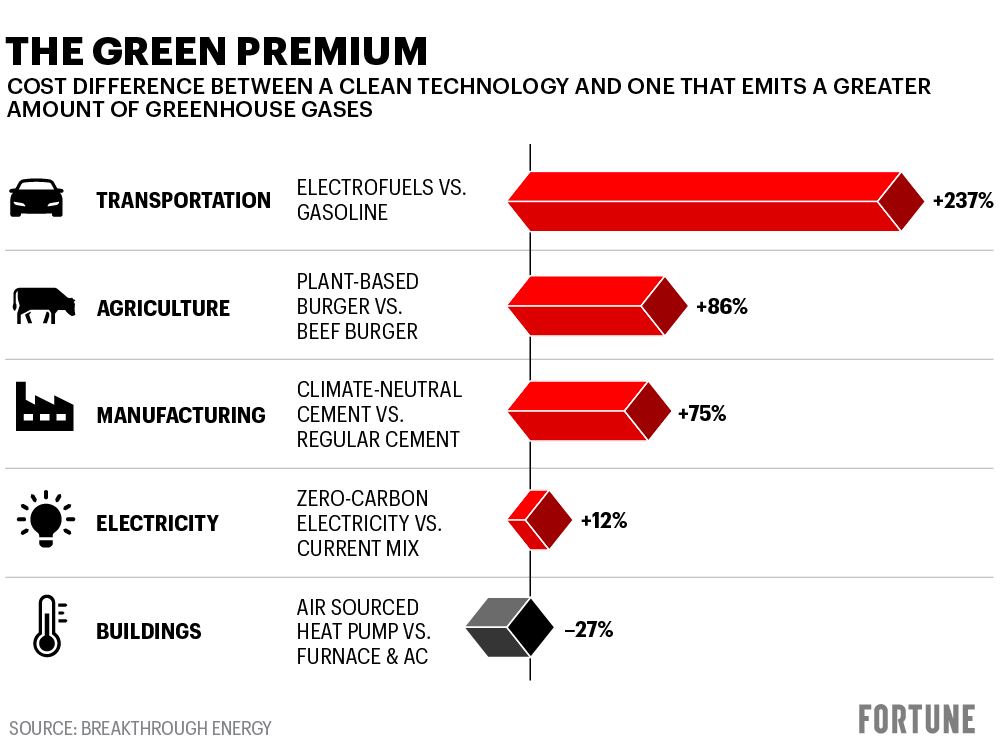

- The most crucial factor for adoption of green technologies is price – winners eliminate “green premiums” (higher costs) compared to existing products

- Climate technologies that provide tangible value (e.g., better, cheaper, faster) gain traction – merely being environmentally friendly is not enough

- Try to ride learning curves (where input costs decrease with scale), which play a significant role in success

- Startups producing hardware need a software or business model moat, or they will can be commoditized and fail in the long-term

- Software was the major winner of "CleanTech 1.0". Beware of: foreign comparative advantage, bad fits for VC funding and timelines, slow sales motions into regulated industries, betting on regulation (e.g., cap-and-trade), and commercializing fundamentally new materials and processes

- Ride policy changes, as government regulations can have a profound impact on the price and adoption of climate technologies (Tesla and solar as great examples)

- Get used to bits + atoms – while software like carbon accounting and carbon marketplaces are essential, reducing emissions requires the physical world

- The usual startup rules for success also apply: speed, new thinking, product + go-to-market, boldness, etc.

Closing the "green premium" cost gap is crucial for accelerating adoption rates – from solar power to Tesla, getting to cost parity is the single most important way for a green product to get adopted by the mass market.

Finding the size of green premiums today can also help tell whether scientific innovation is still required, or the technology is ready for engineering/business model innovation. High green premiums require innovation to drive out a lot of cost still.

As one example, lab-grown meat is much more expensive than ground beef or even tuna, a common wedge to enter the market. With such a high green premium, we need innovation (and new bioreactors) to get closer to a viable product.

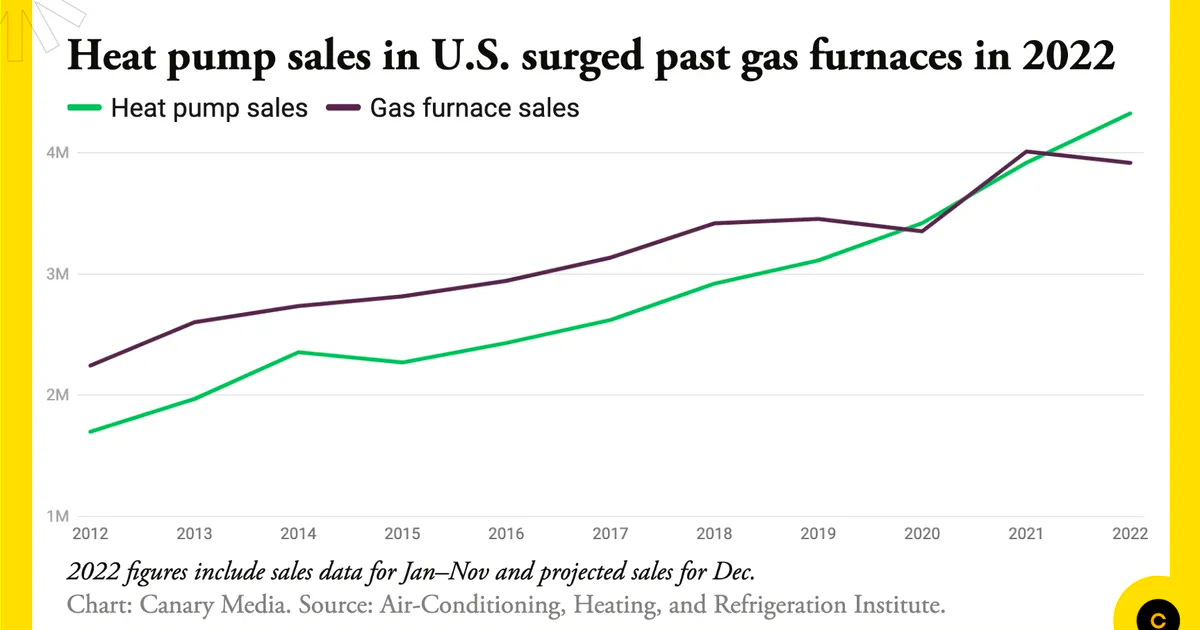

On the other hand, heat pumps are highly economical and widely used in Europe and Asia, but many people in the U.S. have never heard of them. With new incentives and the right business model, their uptake should be rapid in the U.S.

Provide tangible value – be better, cheaper, or faster

Climate technologies typically need to be better products (as judged against core consumer value props) to get adopted – not just green.

Tesla pulled forward electric vehicles because the Roadster was a cool car with insanely good features and rapid acceleration, that also happened to be electric. As the cost of batteries has come down, adoption of EVs has grown tremendously.

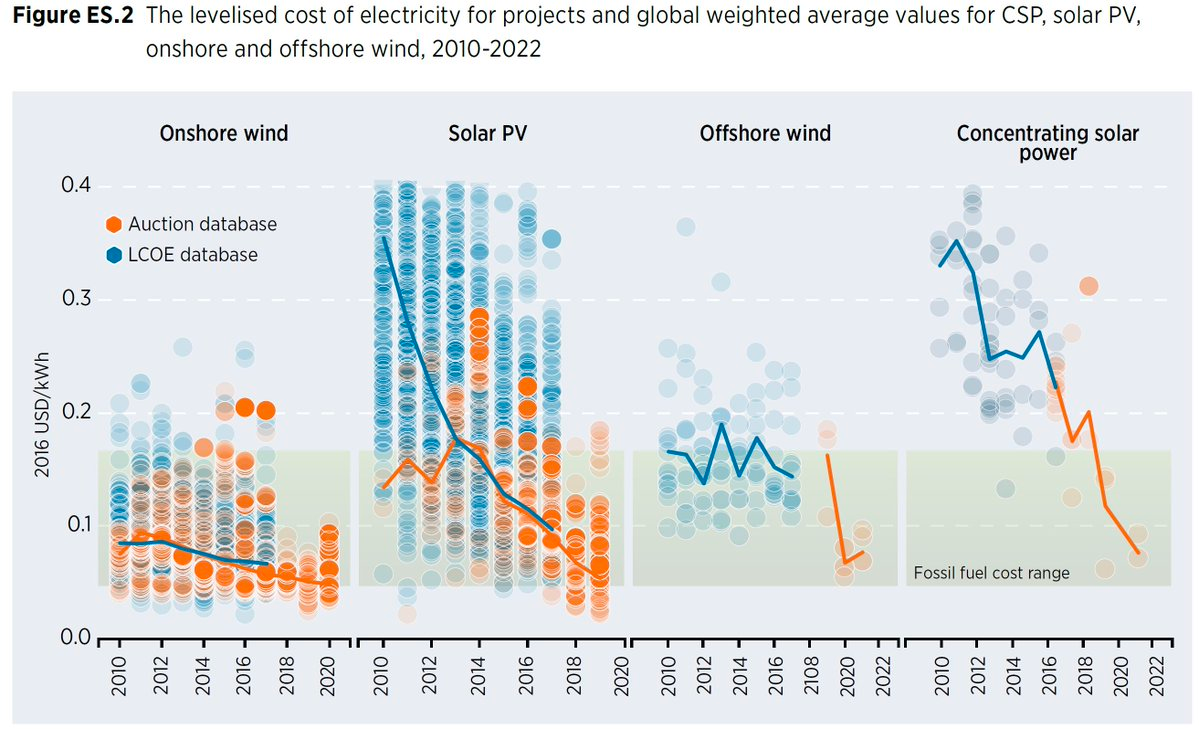

Solar and wind power have seen remarkable growth largely because they’re among the cheapest ways to build. They also are insulated from oil and gas price shocks. In many regions, building and operating a new solar plant will soon be cheaper than operating an existing coal plant!

Plant-based meat tells the opposite story. Impossible Foods and Beyond Meat have stalled out on growth, struggling due to higher cost and concerns about taste and health. Plant-based burgers will need to be cheaper, healthier, or tastier than beef burgers to win the market.

Learning curves drive success

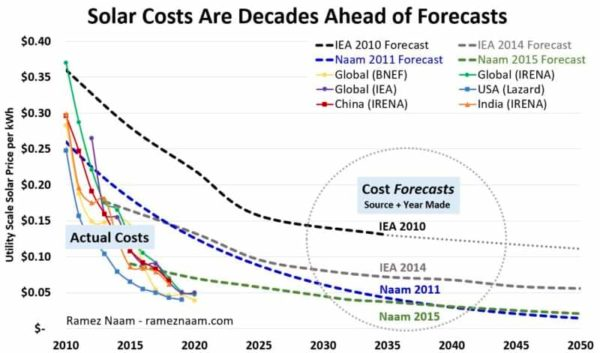

Every time we forecast the future price of solar, we underestimate progress.

Swanson's law, analogous to Moore's law in computing, describes a ~20% steady decline in the cost of solar photovoltaic (PV) modules as install capacity doubles. As a result of growing usage, prices have continued to drop.

Learning (or experience) curves are a generalization of this trend where progress increases with experience, and have played a significant role in the success of many technologies – from airplanes to computers.

Technologies that see learning curves trend tends to be things you mass produce, build modularly, use abundant and cheap input materials, with adjacent industries also bearing R&D costs. Silicon is not the most efficient solar cell and lithium is not the most effective battery, but they have other advantages of abundance, cost, and parallel industries doing R&D at the same time, creating speed advantages.

Things without learning curves tend to be things you construct rather than mass produce, heavily regulated industries, and products that are already at saturation where there's little incentive to increase install capacity.

Avoid the valley of death: scaling issues and Chinese manufacturing killed the U.S. Cleantech boom

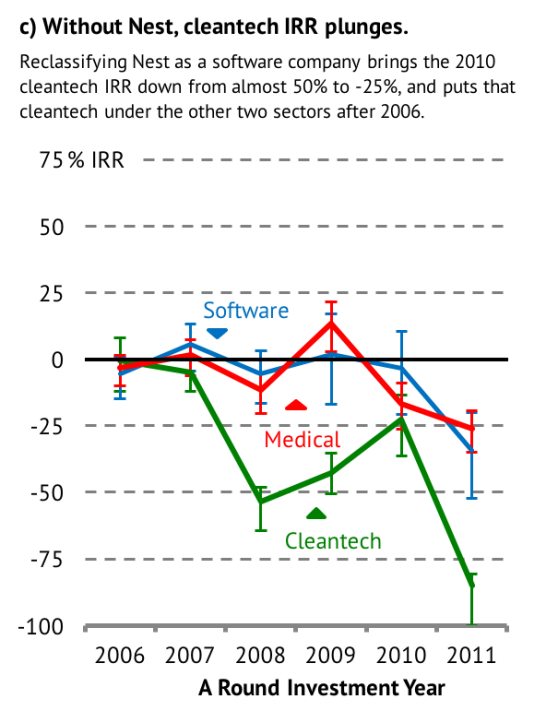

The failure of many “Cleantech 1.0” companies provides valuable lessons for the current generation – the VC model doesn't work for many technologies. From 2006-2011, over $25B was invested in CleanTech, and over half of the money was lost.

It’s a well studied problem – MIT has a great overview, and in summary of returns to the Series A investment:

- Companies developing new materials, processes, or chemicals returned ~17%

- Hardware integration companies returned ~5%

- Cleantech software companies—like Nest and Opower, returned ~350%

- Deployment finance companies (capital for solar farms) return ~25%

- Other companies including energy efficiency consultants and waste processing services returned ~20%

The biggest winner was, perhaps unsurprisingly, software. The biggest money loser were the cleantech companies commercializing fundamentally new materials and processes.

Another major reason was that many U.S. “Cleantech” companies focused on solar photovoltaics or batteries. When Chinese companies entered the market with cheaper and better manufacturing processes, costs fell 10x and the U.S. companies all failed.

Another key reason was the VC model itself. The "Valley of Death" is the period when a company struggles to bridge the gap between pilot-scale operations and commercial viability, which can be 10-20 years in cleantech – and comes with enormous capital requirements. As a result, many companies got stuck in the “Valley of Death” and ran out of capital.

A few key learnings from Cleantech 1.0:

- Beware of supply chain shocks and foreign comparative advantage

- Beware of risky timelines, bad fits for VC funding, and duration of financing

- Software companies were the major U.S. winners

- Focus on profitable businesses with engineering and business models at their core

- Sales motions can be so slow into regulated industries that companies fail

- Don’t bet on companies that need regulatory support to work (e.g., cap-and-trade)

(Good) policy is your friend

Government policy plays a vital role in shaping the success of technologies, for better or worse.

From basic science research, to Germany and China driving renewable energy adoption by jump-starting the market, and the U.S.'s tax credits and subsidies for electric vehicles – supportive policies can drive the transition to entirely new markets.

Germany kick-started manufacturing scale solar photovoltaics, and Chinese subsidies caused the building of so many low-cost silicon PVs that prices dropped over 80% in a few years.

Lots of climate startups today look for government contracts to get them through the Valley of Despair, just like space startups have been doing. Policy and government contracts can be your friend, if you're thoughtful about it.

Get used to bits and atoms!

While software (bits) play a crucial role in addressing climate challenge, real impact requires interaction with the real world (atoms).

Every person who wants to start a climate company will inevitably think of building a carbon accounting tool, a carbon marketplace, or some new financing mechanism.

While pure software solutions are important, they don’t impact the environment directly. If you want to actually reduce emissions, you’ll need to touch emissions in some way – which means atoms. Beyond that, they tend to be extremely crowded spaces.

As a result, unless they're commercializing novel science from a lab group, startups should explore opportunities that involve both "bits" (digital tools) and "atoms" (physical solutions) to both have a moat and drive significant change – like Tesla, Nest, and many others before!

I hope you enjoyed Part 3! In Part 4, we’ll be looking at the opportunities that are the most interesting to tackle in climate tech today.